Are your financial habits preventing you from building the type of wealth you deserve?

Don’t worry, you’re not alone, we’re not born with good money habits, we learn with practice over time.

We’ve all been there–the kids need things, the car breaks down and now you need to replace the alternator, or you’re finally going to be able to book that vacation that you have been postponing for years.

You work your butt off and you deserve to splurge once in a while. Why not, right?

Not so fast, priorities first my friend! After the bills are paid, it’s natural to want to live a little and enjoy that extra cash, but deep down you know that the right thing to do is use that extra cash to pay down that balance on your credit card.

If you’re one of the lucky ones that don’t carry a credit card balance, you should be using that extra cash to build up your emergency fund.

NOTE: Realize that things will always come up, no matter how prepared you think you are. Bottom line: Either you figure out how to make it work, or you’ll never reach your financial wealth goals.

If you truly want to reach your financial goals (most recently coined as the FIRE Movement), you need to commit to understanding your finances to a granular level, otherwise, you’re always going to be playing catch up.

Good news! No matter what your situation is, there’s always something you can do to improve your finances.

In this article, we’ll cover 7 good financial habits that can help you build financial wealth over time.

NOTE: Building financial wealth take years of consistently making the right decision, it WILL NOT happen overnight, no matter what that other self-proclaimed personal finance guru said.

Some of the things we’ll cover in this article are:

- The importance of having an emergency fund, and how to get started.

- How paying your bills on time (or early) can help you build wealth.

- How your credit card can prevent you from building wealth, and how to use them wisely.

- How you can start putting money in the savings account weekly without any effort.

- And much more…

Let’s get started.

Building an emergency fund

An emergency fund is basically money set aside in case of a financial emergency such as an unexpected family illness, a loss of employment, major home repairs, broken down vehicles, etc.

Why should you have an emergency fund?

The purpose of the emergency fund is to give you a “financial safety net”, to prevent you from incurring additional debt by tapping into your credit cards or your retirement accounts like your 401k.

The sad reality is that most Americans don’t have enough money to cover a financial emergency.

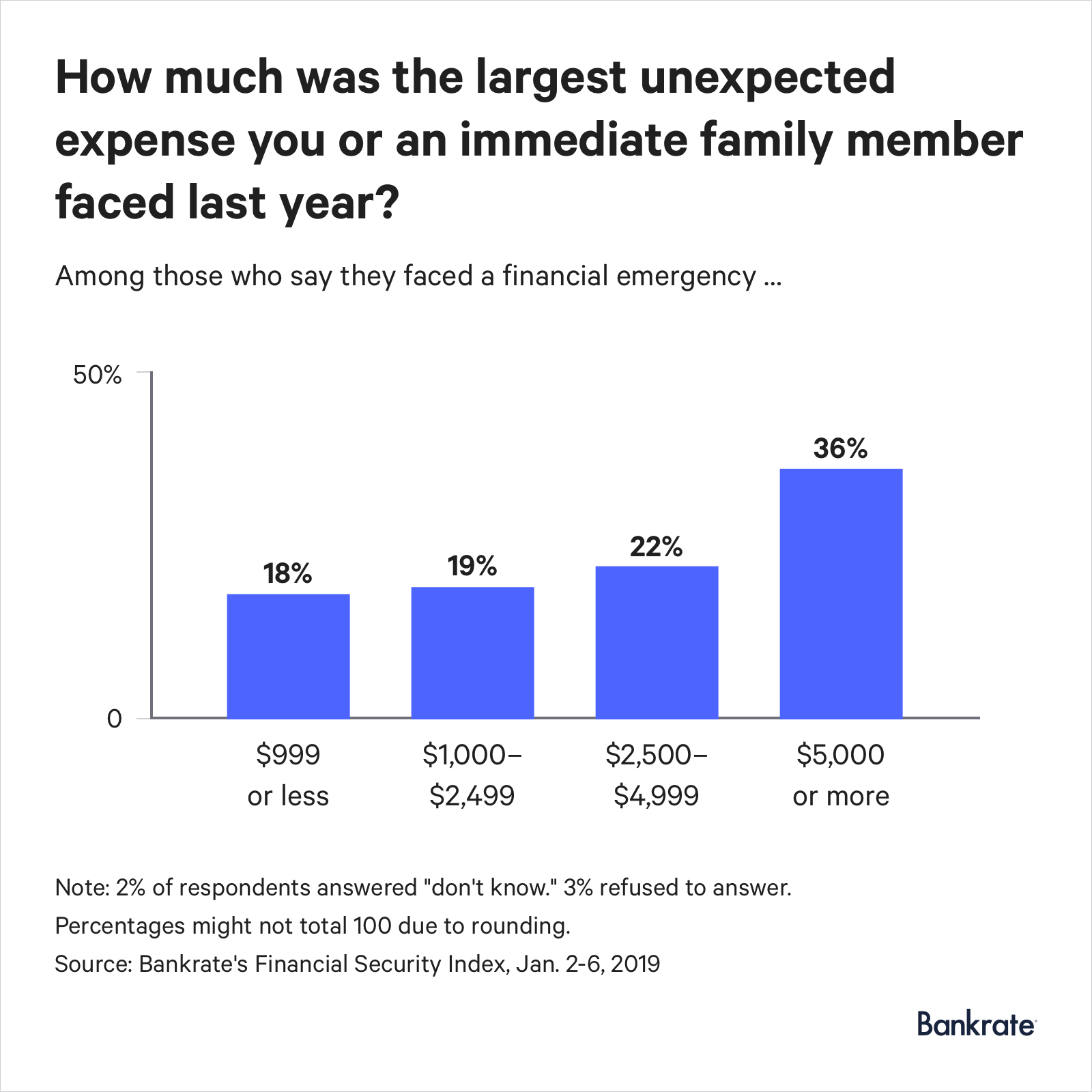

According to a recent Bankrate financial security survey, 34% of American households experienced a major unexpected expense over the past year.

However, ONLY 39% of survey respondents said they would be able to cover a $1,000 setback using their savings.

Most Financial Advisors recommend you should have at least 3-6 months of your monthly expenses saved up as emergency funds.

However, these days 3 months of savings is not enough, I recommend you strive to have 6-12 months of your monthly expenses saved up for emergencies.

Over time, you should challenge yourself to go to 18 months, and then to 24 months, and so forth. The more you put away, the better off you’ll be in case of an emergency, and will give you peace of mind that’s priceless.

Benefits of having an emergency fund

- It helps keep your stress level down.

- It prevents you from incurring additional debt through credit cards and personal loans.

- It keeps you from making bad financial decisions.

Here’s a great video from Dough Roller that explains what an emergency fund is and how to manage one.

Setting aside whatever dollar amount you can weekly is a good starting point (and a great personal finance habit), especially for something that will help you build a cushion to use during bad times.

So, get started and begin building your emergency fund TODAY! Even a few dollars each week is a great start.

Note: I have auto withdraws every Friday to take money from my checking account and deposit it into our savings account. This way I don’t even have to think about it.

Pay your bills on time (or early)

It’s crazy the number of people that I talk to and tell me they pay some of their bills late, and they’re fine with doing that.

I get it, I’ve been there myself many times. You forget to send that payment in by the due date, so now that bill is costing you a lot more money with late fees.

The problem is that most people don’t realize that if you have a history of paying your bills late, it will have a negative effect on your credit score, which will ultimately reduce your credit score and cost you more money whenever you need to make a large purchase on credit.

Manage your bills with a personal finance tool

These days is super easy to manage all your bills and even automate bill payments, straight from your cell phone. You can use a personal finance tool such as Mint, or even your own bank (normally referred to as Bill Pay).

When you use tools like Mint to manage and automate your bill payments, you can avoid paying late fees, as long as you set everything up correctly and make sure all your accounts are up to date.

NOTE: I’m a big fan of Mint, my wife and I can both open the app at any time and check to see what bills are due in the next few days or weeks, and make sure we have enough to cover those bills at all times.

Even for the bills that are automatically paid, the app still gives me notifications to let me know which bills are approaching their due dates.

Available for Android and Apple, Mint allows me to visually see the bills that are due throughout the month, their amounts, and I can forecast cash coming in (work, hobbies, etc.) so I can see if I’m going to be short a week or not.

Even though Mint is a great personal finance tool that does a great job helping you manage your bills, it’s still your responsibility to follow the basic principles of personal finance and prioritize the most important bills that are coming due first.

If the electric bill is coming up in a week, don’t wait to pay it, get it paid NOW before you get tempted to spend the money on other things that are not important.

You need to develop the habit of sitting down once a week and making sure there are enough funds in your checking account to cover any upcoming bills. If you can, get in the habit of paying your bills a few days, or even a week before. That way you’re always ahead.

Limit your credit card use

Your credit card is an amazing personal finance tool with incredible power.

- If you use it properly, it can help you build your credit AND your wealth.

- If you use it incorrectly, it can destroy your credit AND your wealth.

I get it, it’s easy to just whip it out and swipe it, and is convenient because you’re not spending your hard-earned money right away.

But the reality is that credit cards are notorious for aiding in making impulsive purchases, especially for things that we really don’t need AND can’t afford!

So, how can you use your credit card in a way that helps you build your credit AND your wealth?

By understanding the benefits of using your credit card, how to use it, when to use it, and when not to use it.

How do credit cards work?

The first thing you need to know is how credit cards work, and how they can work for you. In simple terms, a credit card is basically a short-term loan to you from the credit card issues, such as Chase Bank or Capital One.

Unlike a debit card, which takes money from your checking account, a credit card uses the issuer’s money and then bills you later.

Benefits of using your credit card (responsibly)

Because your card activity is reported to the credit bureaus (which doesn’t happen with debit cards), using credit cards responsibly can help you build good credit.

This credit history will help you when it comes time to apply for bigger loans like a mortgage, or when you’re applying for a job or apartment.

Using your credit card the right way also helps you build financial muscles and teaches you how to be fiscally responsible.

Avoid misusing your credit card

Racking up your credit card balance over time and not paying off the balance at the end of the month leads to interest on the balance, sometimes even that pesky “cash advance” fee that some cards charge.

Another issue with credit cards is that by default, your account is set up to pay only the minimum, so if you pay the minimum over multiple periods, that balance will continue to exponentially grow and it will be difficult for you to catch up to it.

The biggest issue with carrying a balance on your credit card is that it lowers your credit score and ultimately keeps you in debt for a longer period.

Need help finding the right credit card that fits your needs? Check out the Credit Card Comparison tool on NerdWallet.

If you’re planning to use your credit cards, please use them responsibly, pay off the balance at the end of the month, and try not to carry a balance from month to month to avoid throwing money away on fees, and to avoid hurting your credit score.

Save money from EVERY paycheck

They say that good habits are hard to form, but when they’re formed, they cause a ripple effect and ultimately help you build a better life.

Personal finance is no different, on the contrary, forming good financial habits will help you reach your financial goals and have a positive effect on your life.

So, you may be thinking that saving money from every paycheck is impossible, but I’m here to tell you that it is NOT impossible, it is possible!

How? By automating money transfers from your checking account into your savings account, every single week…automatically. Let me explain.

How to automate your savings.

Every Friday, $1 million dollars (just kidding!) is withdrawn from my checking account and deposited into the savings account.

The process is super simple to set up through your checking account, and because you’re automating the process, you don’t even have to think about it!

First I started with $25 every Friday, it wasn’t much, but I saw progress and that actually helped me cut back on dump things so I can raise that weekly amount.

Currently, there’s an automatic transfer from my checking to my savings for $100, so that’s $400/month that’s being saved without me doing anything.

Ideally, you want to save as much as you can, but you can start low and work your way up as you fully understand your monthly expenses and when they’re due in relation to other larger bills. If you’re tight on money, now is the perfect time to automate your savings.

If you don’t save any money now, how will your situation change?

Avoid impulsive spending

We talked about impulsive spending and how it can destroy your credit score if you’re using your credit cards for impulsive purchases, now let’s talk about impulsive spending in general.

A big misconception is that impulsive spending is only for big-ticket items, tangible things that you don’t need and cost a lot of money.

The fact is that impulsive spending can range from any dollar amount and can be for anything.

Take for example breakfast in the morning at Burger King, if you buy a combo with orange juice, do you ALSO need to buy a coffee?

Why not get the coffee with the combo instead of the orange juice? Another example, I bought a pair of shoes for work the other day and the second pair was 50% off, did I really need the second pair?

Of course not, I only needed one pair, but I made the decision out of impulse (and I was persuaded) to buy the second pair anyways.

How to avoid impulsive spending.

Before you make a purchase, ask yourself, do I REALLY need to make this purchase? Do I REALLY need all those features, extras, etc.?

Once you ask yourself those questions and answer them honestly, I’m pretty sure your decision will change, and that’s a sign that you understand what’s important and you’re learning how to manage your money better.

A recent article by Money Crashers on how to break bad financial habits revealed that “those who are constantly in debt are often the type to snatch up something whether it’s on sale or not – even if the purchase wasn’t exactly planned.”

The question you need to ask yourself is this: Do I truly want to reach my financial goals? If you do, then ask yourself: Is the purchasing decision I’m about to make out of impulse, or do I truly need it?

Be honest with yourself, be brutally honest with yourself, and challenge yourself to avoid impulsive spending at all costs.

When you’re feeling the urge to spend some money, realize that each dollar you spend cost you time to make it, so consider how much time you had to put in to earn that dollar.

Max out your retirement contributions

Let’s be honest, retirement planning is not a great conversation starter, not if you’re under 55 years old! When it comes to retirement planning, most people have no clue where to start, what their options are, and how to get started.

The good news is that there are 3 retirement plans, the 401(k), the Traditional IRA, and the Roth IRA.

401(k) Retirement Plan

The 401(k) plan is an employer-sponsored retirement plan, which is the best-known retirement plan for workers.

Most companies match a certain percentage towards your retirement plan, which is essentially FREE money.

Some companies require you to work there a certain number of years for you to earn & keep (vested) that money, so is good to take advantage of this opportunity to earn some free cash.

The biggest benefit of a 401k plan is that contributions are made with pre-tax dollars, which means that the money you’re putting into your 401k plan grows tax-free, but it is taxed when you pull it out when you retire.

The Traditional IRA

The traditional IRA (Individual Retirement Account) is similar to a 401k retirement plan, but it has a few limitations such as how much you can contribute annually.

The biggest benefit of this plan is that the plan is held by you, which means you own it and are responsible for the plan.

This also means that you get to choose where the plan is held, such as your local bank or a brokerage firm.

Another benefit is that you can clearly see how much the plan is costing you in management fees and fund expense ratios.

The Roth IRA

The Roth IRA is the newest type of retirement plan, which is similar to the Traditional IRA, but it has income limitations.

However, a major difference is that your Roth IRA does NOT provide a tax deduction the year you make your contribution, you are essentially investing AFTER tax.

That means that while a Traditional IRA plan or a 401k plan will be taxed when the funds are withdrawn, a Roth IRA plan will not be taxed with you withdraw the funds because you paid the income tax on those funds when you invested them.

NOTE: For more information regarding retirement plans, please consult with your financial advisor, or learn about these plans from websites such as NerdWallet.com and RothIRA.com.

“It’s better to start contributing a little bit now than to wait until you can contribute a lot.”, says Jeff Rose, a Certified Financial Planner and founder of Good Financial Cents.

How to make the most of your retirement contributions.

If you have a 401k retirement plan (and you SHOULD), you should be optimizing your 401k plan every year.

Diversifying and balancing your allocations will minimize your losses in the event of a major market downturn.

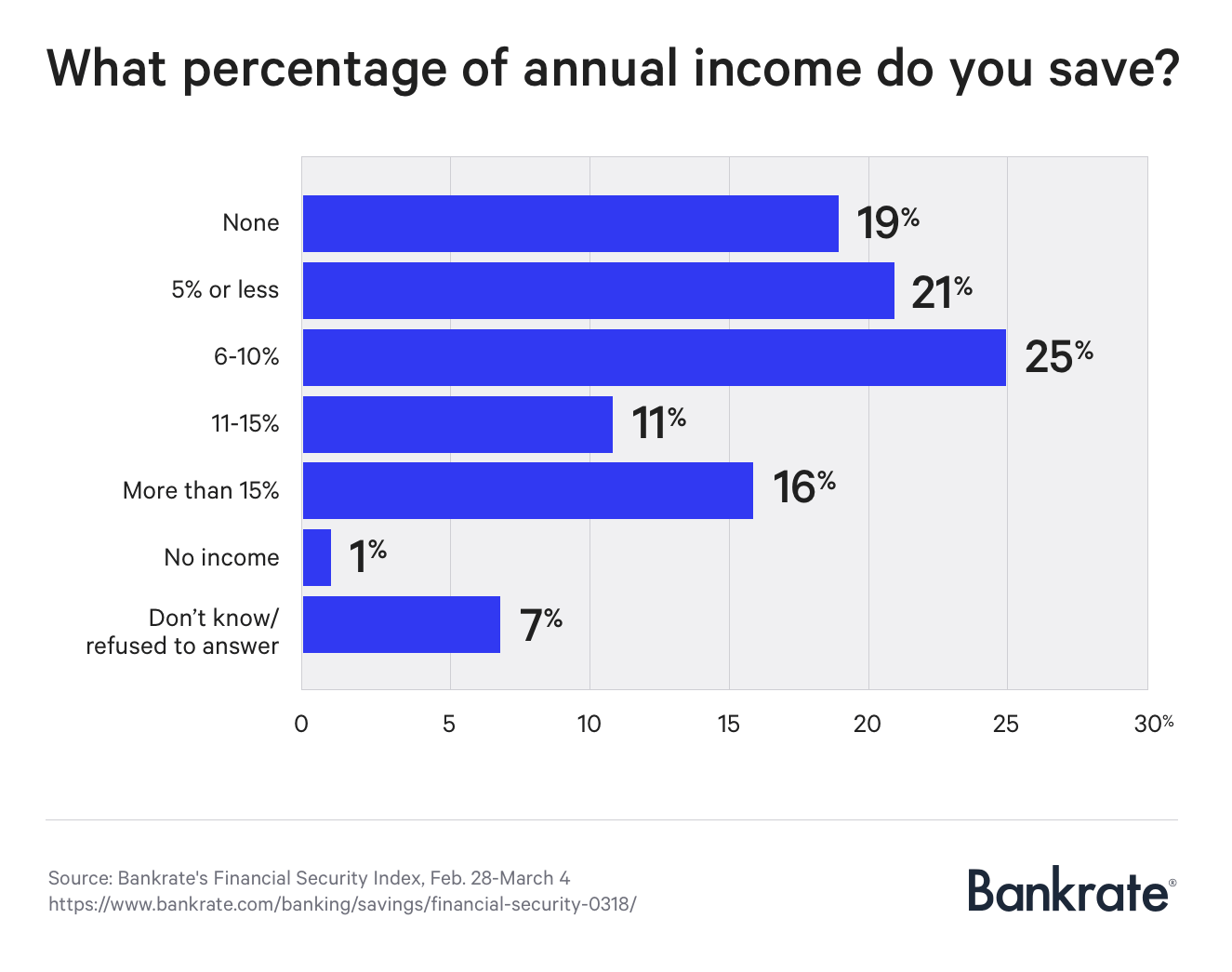

A 2018 Bankrate survey reported that 20% of Americans are not saving enough for retirement.

These statistics are alarming, especially how easy it is to save money for retirement these days.According to the survey, “expenses are the biggest obstacle, with 39% of the respondents citing this as the main reason they’re not saving.”

Invest the time to learn about personal finance

Personal finance is not complicated, people make it complicated.

The basic principle of personal finance is to have a healthy balance between income and expenses, with the goal of having more money left over after all expenses have been paid and money has been saved for emergencies and for retirement.

That’s it, that’s the basic principle of personal finance. So, why is personal finance so intimidating to people? Why do people shy away when personal finance and money is brought up in conversations?

Because some people simply do not understand personal finance, they barely know how to manage their own money.

The best way to learn personal finance is to read books. As Jacob Dayan, CEO & Co-Founder of Finance Pal says, “Read at least one personal finance book per year.” If reading is not really your thing, there are thousands of free videos and even free courses on Youtube and Udemy you can access right now.

So take the time and learn about personal finance, it will be the best investment you will ever make in your life.

Good Financial Habits – Final Thoughts

Anyone can learn about personal finance and learn how to build wealth over time, the question is if you’re willing to put in the time to truly learn.

Just like LeanMoola, there are thousands of other personal finance blogs and magazines that can help you understand personal finance, and show you how to apply some of the practical tips to your own situation.

If you’re more of a visual person, Youtube has hundreds of thousands of videos on personal finance.

If you truly want to improve your finances and have a better life, you need to want it bad enough and have the mindset of doing whatever it takes to learn.

DISCLAIMER: This post may contain affiliate links to products and services, for more information please review our Affiliate Disclaimer page.

0 Comments